The 4-Minute Rule for Accountant Lincoln

Wiki Article

Get This Report on Accountant Lincoln

Table of ContentsAbout Accountant LincolnSome Known Facts About Accountant Lincoln.Getting The Accountant Lincoln To WorkNot known Factual Statements About Accountant Lincoln All About Accountant Lincoln

Tip While some accountancy companies focus on niche solutions such as tax obligation approach, many will certainly use accounting and payroll services, tax obligation preparation as well as company assessment solutions. Tax Obligation Preparation as well as Prep work There is a lot even more to exhaust planning as well as preparation than finishing tax obligation returns, although accountancy companies prepare both state and government company tax returns.Service owners can likewise provide bookkeeping firms authority to stand for business proprietor's rate of interests concerning notices, details requests or audits from the Irs (IRS). Furthermore, company owner need to develop organization entities that develop most positive tax obligation circumstances. Accountancy firms help identify the finest options which help in the creation of entities that make the most effective tax obligation sense for the company - Accountant Lincoln.

However service proprietors aren't constantly experts at the economic elements of running a company. Accountancy firms can aid with this. Accountant Lincoln. Duplicates of service checking account can be sent to bookkeeping firms that collaborate with accountants to keep precise money flow records. Accountancy firms likewise produce earnings as well as loss statements that damage down crucial locations of costs and also revenue streams.

Not known Facts About Accountant Lincoln

Accountancy firms utilize sector information, in addition to existing company monetary history, to calculate the information.Whether you have actually just recently established a minimal company or you have been handling your financial resources separately previously, working with an accounting professional might be the best point you do during the very early days of running your service. Trying to manage your company's audit as well as tax obligation events can be laborious and difficult unless you have previous experience, and also can also take important time far from the day-to-day running of business - Accountant Lincoln.

What will your minimal firm accountant do for you? Establishing your restricted company by means of Firms Home (presuming you have not currently done so). Take treatment of the initial tax obligation enrollment kinds for your firm, including Corporation Tax, Worth Included Tax obligation, and also registering your organization as an 'em ployer' (so you can run a pay-roll for the supervisor and also employees).

Accountant Lincoln Fundamentals Explained

Service is perhaps more crucial as there's absolutely nothing worse than an unstable accounting professional. Prior to signing up, figure out if you will have a specialized point of call. Some firms run a kind of 'conveyor belt' system where you may not recognize from everyday who to speak to if you have a question.

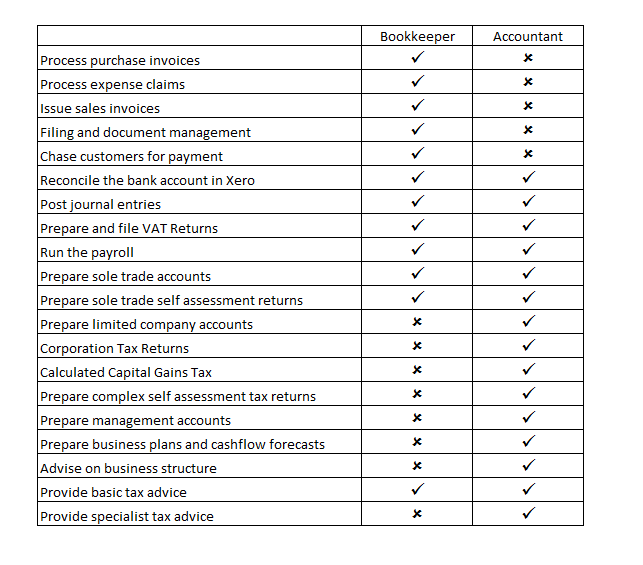

What does a bookkeeper do? A bookkeeper's job is to keep total records of all cash that has come right into and also gone out of the service.

Accountant Lincoln Things To Know Before You Get This

You can find more info on which transactions require supporting papers on the IRS website. There are no formal academic demands to become a bookkeeper, but they have to be educated regarding economic topics as well as accountancy terms and make every effort for accuracy. Normally, an accountant or Go Here proprietor supervises a bookkeeper's work. An accountant is not an accountant, nor must they be taken into consideration an accountant.

Based upon that computation, choose if you need to work with someone full-time, part-time or on a task basis. If you have intricate books or are bringing in a whole lot of sales, work with a licensed this content or certified accountant. A seasoned accountant can give you satisfaction and also confidence that your finances are in excellent hands, yet they will additionally cost you extra.

A Biased View of Accountant Lincoln

Tracy in his book Accountancy for Dummies." [They] go back and state, 'We deal with a whole lot of refunds, we take care of a lot of vouchers. Just how should we record these deals? Do I tape simply the net quantity of the sale, or do I videotape the gross sale amount, too?' When the accounting professional chooses how to handle these deals, the accountant carries them out."The audit procedure produces reports that bring key facets of your organization's finances together to give you a complete photo of where your finances stand, what they suggest, what you can as well as need to do concerning them, as well as where you can anticipate to take your organization in the near future.

Bureau of Labor Stats, the median wage for an accounting professional in 2020 was $73,560 per year, or $35. 37 per navigate here hr. Their years of experience, your state as well as the complexity of your bookkeeping requires affect the rate. Accountants will either price quote a client a set price for a certain service or charge a general hourly rate.

When to work with a monetary specialist, It can be challenging to determine the suitable time to employ a bookkeeping specialist or bookkeeper or to establish if you need one in all. While lots of small services work with an accountant as a specialist, you have several choices for taking care of economic tasks. As an example, some small company proprietors do their very own bookkeeping on software application their accounting professional recommends or uses, giving it to the accounting professional on an once a week, month-to-month or quarterly basis for activity.

Report this wiki page